(Mike Maharrey, Money Metals News Service) After crashing in February, consumer borrowing remained tepid in March, a worrying sign for an economy that runs on credit cards.

Borrowing has been slowing for the past several months, raising the prospect that Americans may finally be edging close to their credit limits.

Total consumer credit rose 2.4 percent in March after contracting in February, according to the latest data from the Federal Reserve. March borrowing was close to January levels.

Even with the slowdown in borrowing, American consumers are still buried under $5 trillion in consumer debt.

The Federal Reserve consumer debt figures include credit card debt, student loans, and auto loans, but do not factor in mortgage debt. When you include mortgages, U.S. households are buried under a record level of debt. As of the end of 2024, total household debt stood at $18.4 trillion.

Revolving credit, primarily reflecting credit card debt, rose by just $1.9 billion, a 1.7 percent annual increase. This compares with a 5 percent increase in January and a 20.2 percent surge in December.

Americans have now run up their credit card balances to a record $1.32 trillion.

The double whammy of rising debt and interest rates exacerbates the debt problem. The average annual percentage rate (APR) currently stands at 20.12 percent, with some companies still charging rates as high as 28 percent. The average is only slightly down from the record high of 20.79 percent set last August.

Rates aren’t coming down much, even with Federal Reserve rate cuts. According to an ABC News report, despite a full percentage point in rate cuts, credit card companies are charging a higher margin “to weather default risk, cover overhead costs and recoup profits, experts added.”

“Credit card rates are high, and they’re staying high,” Bankrate analyst Ted Rossman told ABC News.

The Fed’s pause in rate cuts is more bad news for consumers buried in debt.

Americans are starting to struggle to pay those high credit card bills.

According to the New York Fed, in the fourth quarter of 2024, “Aggregate delinquency rates ticked up 0.1 percentage point (ppt) from the previous quarter to 3.6 percent of outstanding debt in some stage of delinquency.”

According to PYMNTS Intelligence, credit cards are the loan type with the highest share of balance 90+ days delinquent, currently at 11.5 percent.

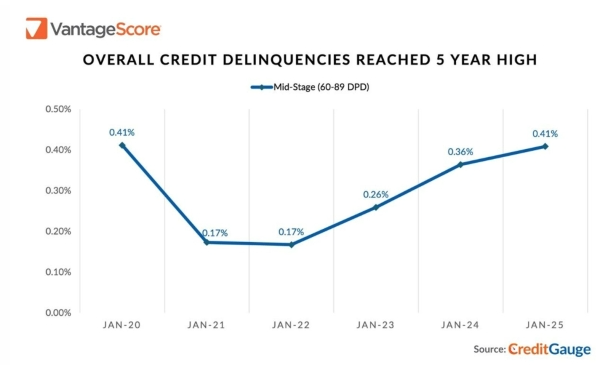

According to CreditGauge, consumer credit delinquencies hit the highest level in five years in 2024.

“The combination of rising mid-to-late-stage credit delinquencies and rising credit balances suggests a growing debt burden that some consumers are increasingly struggling to manage.”

As traditional credit avenues creep closer to their limits, it appears that consumers are turning to buy-now-pay-later to keep spending. According to PYMNTS, “The torrid pace of activity at the likes of Sezzle and Affirm — as many categories saw double-digit spending (and Sezzle notched triple-digit revenue growth) — has far outstripped the growth in the Fed’s data.”

Subprime credit card borrowers are struggling the most, with delinquency rates nudging upward by about 5.6 percent since the Federal Reserve began raising rates to battle price inflation.

Despite strong retail spending in December for the holiday season, the bigger picture reveals a consumer under stress.

Given these dynamics, it’s no wonder consumers are trying to borrow less.

Non-revolving credit, primarily reflecting outstanding auto loans, student loans, and loans for other big-ticket durable goods, rose by $8.2 billion, a 2.7 percent increase.

This was a significant slowdown from the 5.2 percent in December and is more in line with the tepid growth of around 2 percent in non-revolving credit over the last year, as consumers cut back on big-ticket spending to cover the increasing costs of day-to-day necessities.

Before the pandemic, revolving credit growth averaged 5 percent.

This big drop in consumer borrowing reverts to a trend we saw developing last fall. Credit card spending tanked in August and remained muted in September. They pulled out the plastic again for the holidays, but that might have been a last gasp for the American consumer.

The bottom line is that Americans have blown through the savings they accumulated during the pandemic and have run their credit cards close to the limit. An economy run on Visa and Mastercard simply isn’t sustainable. When Americans finally hit their credit limit, it will have major implications for economic growth.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.