(Mike Maharrey, Money Metals News Service) After rebounding in September, wholesale gold demand in China increased again, defying seasonal weakness.

China ranks as the world’s largest gold market.

Gold prices surged in early October, setting several records before correcting later in the month. Even with the selloff, the Shanghai benchmark price was up 5.5 percent on the month.

After the correction, gold bounced higher in the first half of November, supported by rising risks and improving gold ETF inflows. The Shanghai price (in yuan terms) rose 3.3 percent during the first two weeks of November.

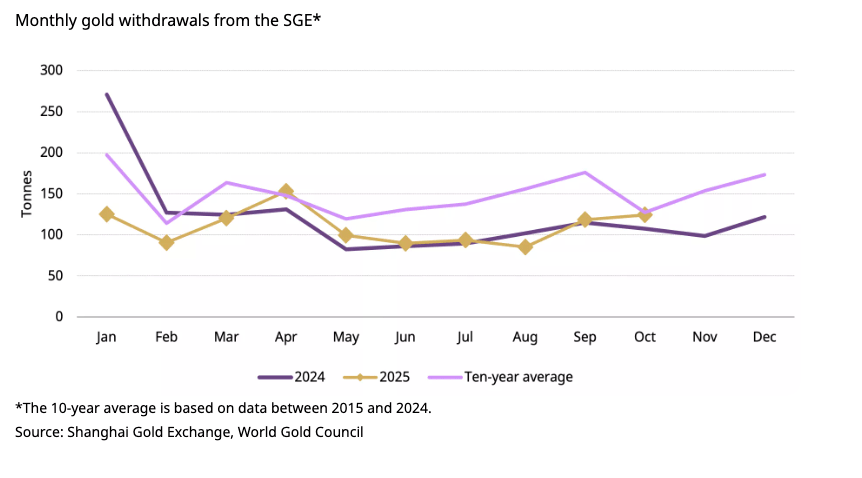

October is typically a down month for Chinese gold demand. However, this year defied that tendency.

Withdrawals from the Shanghai Gold Exchange rose 6 tonnes month-on-month to 124 tonnes. That was 17 tonnes higher than October 2024, and nearly at the 10-year average of 127 tonnes.

According to the World Gold Council, investment buying is supporting Chinese gold demand even as higher prices put a damper on the jewelry market.

Chinese physical gold demand was a primary driver during the early stages of this gold bull market, with bar and coin demand growing by 44 percent year-on-year in H1. Chinese investors snapped up 115 tonnes of gold bars and coins in the second quarter alone. It was the strongest H1 for physical gold buying since 2013.

There was a slowdown in investment demand in July and August as gold was essentially trading sideways, but it rebounded in September.

Gold and coin buying remained strong in October, and there is growing Chinese investor interest in gold ETFs.

Chinese gold ETFs reported gold inflows of ¥32 billion, the highest level since April. That represented 33 tonnes of gold.

Total assets under management (AUM) by China-based gold-backed funds rose 24 percent to ¥210 billion ($29 billion).

ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

While investment demand is booming, higher prices have created headwinds for the Chinese gold jewelry market. According to the World Gold Council, anecdotal evidence suggests purchases were “robust” during the early October nine-day National Day and the Mid-Autumn Day holiday. Even so, “retailers remained cautious in restocking amid the amplified gold price volatility earlier in the month.”

Chinese gold imports at 93 tonnes in October reflected strong demand. That was a 5-tonne increase over September’s imports and 36 tonnes more than October 2024.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.