(With the Teamsters union receiving a significant pension bailout from the federal government, Illinois taxpayers will now be paying for both public and private pension systems.

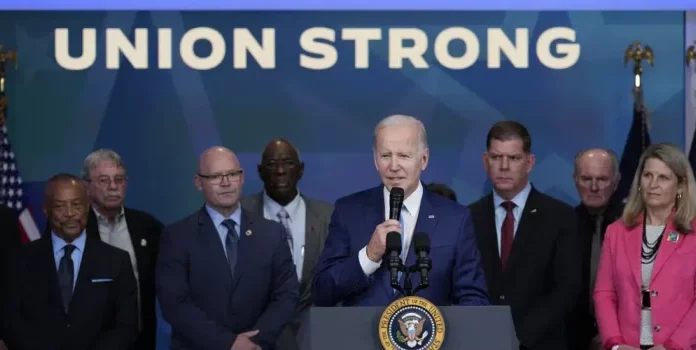

Last week, President Joe Biden announced the federal government would use nearly $36 billion to stabilize the Teamsters union pension plans nationwide. The Teamsters union represents a variety of professions in public and private sectors. There are about 20 chapters in Illinois alone.

The Teamsters union has a total of 350,000 participants in nearly every state in the country with a large portion represented in the Midwest. The most Teamsters are in Michigan and Ohio with about 40,000 participants each. Missouri has about 28,000. Illinois has 25,000. About 22,000 members are in Wisconsin, according to figures provided by the White House.

According to Bryce Hill of the Illinois Policy Institute, the financial impact on taxpayers would be light this time around, but it could lead to more significant bailouts down the road, which taxpayers will have to fund.

“Per taxpayer basis, $36 billion spread across the entire United States tax base seems like a very little amount, and it would be in this one instance,” Hill said. “The bigger concern is the precedent it sets, which could have massive tax implications if we start bailing out public service pensions or doing this more frequently in the private sector.”

Illinois currently has its state government retiree unfunded pension liability at around $140 billion. However, some private investor services project the debt to be over $310 billion.

“We have $140 billion in pension liabilities across our statewide systems,” Hill said. “That is up $10 billion compared to last year, due mainly to missing investment targets.”

Hill said the state is relying on federal tax dollars to fix its own issues.

“I think this is a larger indication of what state and local governments have been hoping for in Illinois, in trying to get a federal payout for what is clearly a broken pension system,” Hill said.

Illinois has among the most unfunded public pension liabilities in the nation.