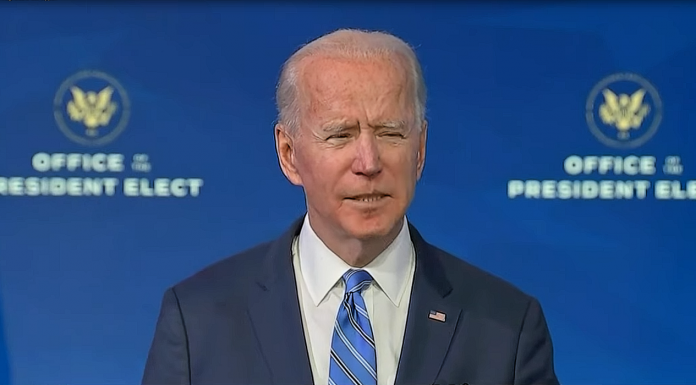

(Headline USA) As if their $6-trillion-plus price tag weren’t bad enough, President Joe Biden’s growing list of federal spending proposals may be even more expensive than previously thought.

The University of Pennsylvania Wharton Business School released a report Wednesday that included some eye-popping figures for Biden’s latest spending proposal, the American Families Plan.

Biden’s recently unveiled the multi-trillion dollar spending plan, masquerading as an “infrastructure” bill, which would fund a range of leftist wish-list items, from paid family leave to free preschool and college-tuition to amnesty for illegal immigrants.

Overall, the report said the Biden administration has underestimated the costs of the plan and overestimated the revenue brought in by newly proposed taxes. The plan would also add a hefty sum to the debt and lower the nation’s GDP.

“The spending on education, childcare and paid leave increases government debt by 11.6 percent in 2050,” the report said.

“Although the public investments boost productivity, the crowding-out effect of higher government debt dominates and decreases the capital stock by 2.6 percent in 2050,” it continued. “The wage rate is higher initially due to the productivity boost from public investments. Over time, however, as the capital stock declines further, the wage rate starts to decrease as well. In 2050, GDP is 0.7 percent lower.”

The report said that by 2050 Biden’s plan would increase the national debt by 5% and decrease GDP by 0.4% “as the effects from larger debt on the economy outweigh the productivity gains associated with the new spending programs.”

Biden has claimed his plan would be offset by taxes increases only for the very wealthy. However the study found his proposed taxes would generate only $1.3 trillion, a far cry from fully funding the major spending bill.

“We estimate that AFP would raise $1.3 trillion in new tax revenue over the same period, including almost $480 billion in additional revenue from enhanced IRS tax collection enforcement,” the report said.

“… [H]igher taxes on capital gains and dividends facing the wealthiest Americans would lower their after-tax return on equity investment and therefore disincentive saving,” it said. “However, since only a very small portion of Americans are subject to the tax increases, the capital stock ends up 1.4 percent higher, which in turn increases the wage rate by 0.5 percent. In the meantime, the increase in the top individual tax rate also discourages labor by high-productivity households. Overall, GDP ends up 0.3 percent higher in 2050.”

The high-dollar cost of Biden’s plans, amidst a growing national debt, have been a key line of attack for Republicans.

“American families can’t afford Democrats’ socialist takeover of the economy, and voters will hold them accountable for their recklessness,” said National Republican Committee spokeswoman Torunn Sinclair.