(Mike Maharrey, Money Metals News Service) After the 2008 financial crisis, the Federal Reserve embarked on nearly a decade of extraordinarily loose monetary policy. This not only incentivized the creation of a Debt Black Hole and introduced all kinds of malinvestments into the economy, but it also warped expectations.

We now have a generation of people working in and reporting on the financial sector who have no clue what a “normal” interest rate environment looks like. This warped perception of financial reality is leading to even more monetary malfeasance.

Between the Great Recession and the pandemic, the Fed injected nearly $9 trillion into the economy through quantitative easing (QE). It also slashed rates to zero for the first time ever in 2008. Rates didn’t lift off zero until December 2015, seven years later. By 2018, the Fed had only managed to push interest rates back to 2.5 percent. At that point, the economy went sideways, and the stock market crashed.

By 2019, the Fed had cut rates three times and ended balance sheet reduction. This was before COVID reared its ugly head. The pandemic gave the central bank the excuse it needed to slash rates to zero again. It wasn’t until March 2022 that the Fed started aggressively pushing rates higher.

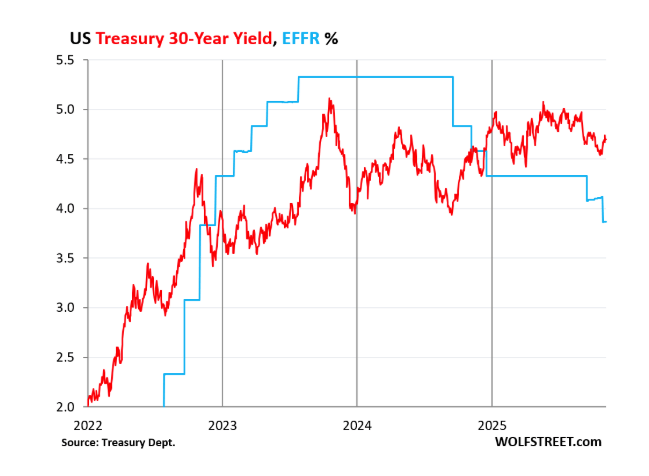

The central bank ultimately drove rates to 5.5 percent. Most people perceive this as a high-interest-rate environment, given the decades of artificially low rates. But from a historical standpoint, that peak was slightly below the historical average.

As you can see from the chart, the Federal Reserve funds rate peaked just above the level of the 2006 peak. (You’ll also want to note the steep decline in rates beginning in 2006, long before the 2008 financial crisis and Great Recession.)

You can also clearly see a general downward ratchet effect in rates over time. Each interest rate peak preceding a bust gets lower as the economy has become more addicted to easy money.

In effect, the economy needs bigger doses of the easy money drug to reinflate the bubble each time through the cycle.

The most notable aspect of the chart is the nearly 10 years of zero percent interest rates following the 2008 financial crisis. This is the real outlier. However, we have millions of people working in the financial sphere who have never experienced a “normal” interest rate environment during their careers. They imagine that zero is closer to the norm than five-and-a-half percent.

Mortgage Rates

We see this same disconnect between present perception and historical reality when it comes to mortgage rates.

The interest rate on a 30-year fixed mortgage was running around 6.3 percent in mid-November. This is perceived as “high.”

It’s not.

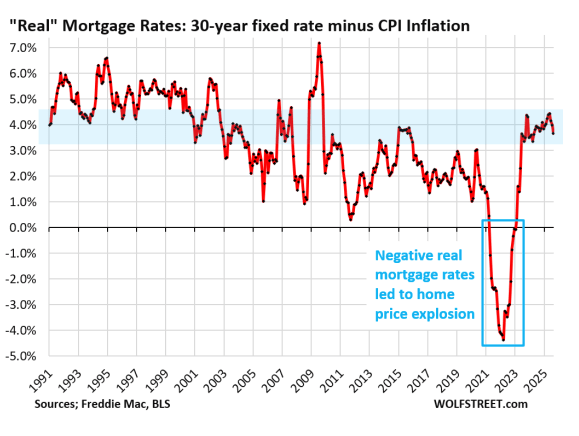

Six to seven percent mortgage rates used to be the lower end of the normal range. That was before the Fed started skewing rates downward with interest rate policy and QE.

As WolfStreet explained, “The 6 percent to 7 percent mortgage rates are now only a big deal because home prices exploded by 50 percent and more in just two years from mid-2020 to mid-2022, after they’d already surged for years, inflating home prices to where they’re no longer economically feasible.”

Ironically, it was Fed policy that blew up the housing bubble to begin with. It was almost as if they learned nothing in the run-up to the subprime crisis and subsequent financial system meltdown in 2008.

“That home-price explosion was a result of the Fed’s reckless monetary policy that created 30-year fixed mortgage rates below 3 percent, while inflation had begun to rage and was heading to 9 percent. The Fed, with its reckless policies, orchestrated negative ‘real’ mortgage rates of -3 percent, -4 percent, and even lower – better than free money, and when money is free, buyers’ brains turn to mush, and prices don’t matter. Then the music stopped.”

This provides some insight as to why the Federal Reserve is intent on cutting rates despite sticky price inflation. In a sane world, the Fed would be holding rates higher and possibly even hiking. Instead, it is cutting into an inflationary environment.

To some degree, it’s a matter of necessity. After decades of low rates and multiple rounds of QE, the economy is addicted to easy money. A debt-riddled bubble economy simply can’t function in a normal rate environment. It needs more of the easy money drug. The Fed had a choice: keep the air in the bubbles or deal with inflation.

It picked the bubbles and surrendered to inflation.

But I also think the expectation of loose monetary policy is something of a self-fulfilling prophecy. As long as people think low rates and money printing are the norm, you won’t find much resistance to this monetary malfeasance. And after decades of easy money, it seems normal. It’s a classic case of perception shaping reality.

But perception is not reality. This easy money world we live in isn’t normal. And imagining that it is won’t change the negative impacts.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.