(Mike Maharrey, Money Metals News Service) Consumer borrowing unexpectedly surged in April as Americans tried to get ahead of potential price increases due to tariffs. This reversed a trend of declining consumer borrowing since the beginning of the year.

Total consumer debt swelled by $17.9 billion in April, a 4.3 percent annual increase, according to the latest Federal Reserve data.

Americans now owe $5.01 trillion in consumer debt.

The Federal Reserve consumer debt figures include credit card debt, student loans, and auto loans, but do not factor in mortgage debt. When you include mortgages, U.S. households are buried under a record level of debt. As of the end of Q1 2025, total household debt stood at $18.2 trillion.

Revolving credit, primarily reflecting credit card debt, jumped by $7.7 billion, a 7 percent annual increase. This followed a rather tepid 2.7 percent increase in revolving debt in Q1. It was the largest jump in revolving credit balances since the holiday season.

Americans are buried under $1.32 trillion in revolving debt.

According to analysts at pymnts.com, the surge in borrowing likely reflected “an April rush that indicates [consumers] sped up purchases as tariffs took effect that same month.”

Consumers paid down some of their credit card debt in the first quarter. This isn’t uncommon, as people pay off temporary balances added during the holiday season.

The problem is that consumer borrowing over the last several months seems to indicate Americans are getting close to their credit limits. The April spending surge could have been a last gasp as consumers move ever closer to the end of a dead-end road. After all, you can’t sustain an economy on Visa and Mastercard forever.

The spending may have also reflected some “consumer resilience” as they received income tax refunds in April.

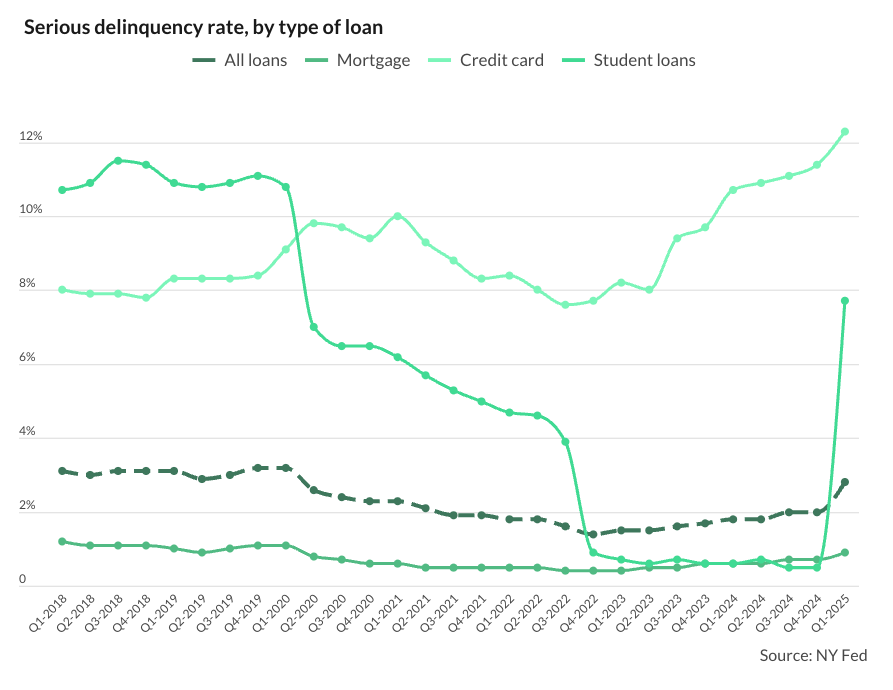

Despite the apparent consumer resilience, there are signs of strain. Late-stage delinquencies on credit card debt surged year over year in Q1. Meanwhile, 4.3 percent of total outstanding household debt is in some stage of delinquency. Serious delinquencies, defined as debts that are 90 or more days past due, rose to 2.8 percent of total debt, a 52 percent increase year on year.

According to CreditGauge, consumer credit delinquencies hit the highest level in five years in 2024.

“The combination of rising mid-to-late-stage credit delinquencies and rising credit balances suggests a growing debt burden that some consumers are increasingly struggling to manage.”

The double whammy of rising debt and interest rates exacerbates the debt problem. The average annual percentage rate (APR) currently stands at 20.12 percent, with some companies still charging rates as high as 28 percent. The average is only slightly down from the record high of 20.79 percent set last August.

Rates aren’t coming down much, even with Federal Reserve rate cuts. According to an ABC News report, despite a full percentage point in rate cuts, credit card companies are charging a higher margin “to weather default risk, cover overhead costs and recoup profits, experts added.”

“Credit card rates are high, and they’re staying high,” Bankrate analyst Ted Rossman told ABC News.

The Fed’s pause in rate cuts is more bad news for consumers buried in debt.

Non-revolving credit, primarily reflecting outstanding auto loans, student loans, and loans for other big-ticket durable goods, rose by $10.2 billion, a 3.3 percent increase. It was the biggest surge in non-revolving credit since July 2024.

Non-revolving debt currently stands at $3.69 trillion.

While the increase in non-revolving credit was larger than the 2 percent in non-revolving credit growth over the last year, it was still much lower than the 5 percent average typical before the pandemic. The growth in non-revolving credit reveals consumers have cut back on big-ticket spending to cover the increasing costs of day-to-day necessities.

After contracting in Q1, there was a big jump in auto loans as consumers tried to get ahead of potential tariffs.

Student loan debt is included in non-revolving credit. Borrowers recently started making payments again. Some student loan recipients have had payments on pause since the pandemic. Delinquencies surged as past-due reporting returned.

Only time will tell if April’s surge in consumer borrowing was a one-off event in response to the tariff threat, or if Americans still have a little wiggle room before they run up against their credit limits. But make no mistake – those limits are looming. An economy can’t run indefinitely on credit cards. The bills always come due. Since the pandemic, Americans have coped with dramatically rising prices by blowing through their savings and relying on credit. It’s not a matter of if the chickens will come home to roost, but when.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.