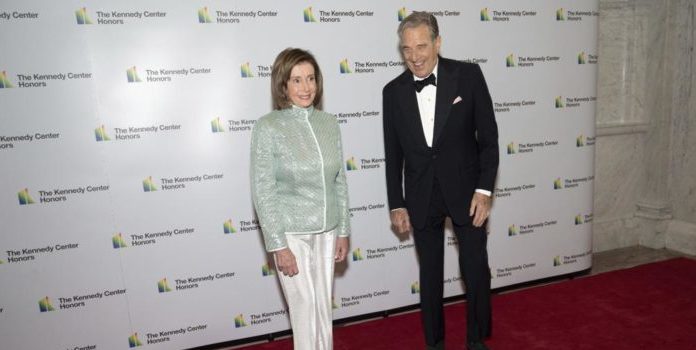

(Chris Parker, Headline USA) Paul Pelosi, husband of House Speaker Nancy Pelosi, D-Calif., drew criticism last week when financial disclosures revealed he had invested heavily in tech stocks ahead of a bipartisan computer chip bill.

However, Pelosi recently sold his Nvidia stocks for a $341,000 loss, reported the Washington Examiner. Shares have since increased by 7.8%.

His wife’s office claimed the sell-off was to stifle accusations of insider trading.

“Mr. Pelosi decided to sell the shares at a loss rather than allow the misinformation in the press regarding this trade to continue,” Drew Hammill, Nancy Pelosi’s deputy chief of staff, said in a statement.

However, Mr. Pelosi has also been criticized for conducting trades that follow his wife’s voting patterns. She denied any knowledge of her husband’s massive investments in tech stocks after her office received significant backlash over the deal.

Other investments included shares of Visa and Apple.

“It just doesn’t smell right,” said Rep. Elise Stefanik, R-N.Y.

“And frankly, it is one of the commitments of Republicans in a majority to make sure that we have the correct rules in place, to make sure that there’s no malfeasance, and to make sure that members of Congress and their family members, particularly their spouses, are not able to profit at all over these types of investing,” she added.

The controversy prompted Sen. Josh Hawley, R-Mo., to call for a hearing to discuss insider trading among lawmakers and their families. It’s also leading to renewed calls for better oversight of government officials.

If passed, the computer chip bill would offer $52 billion in subsidies to chip manufacturers in an effort “to be more competitive with China,” according to Democrats. It’s also expected to increase the federal deficit by $79 billion over the next 10 years.

Republicans initially referred to the bill as “corporate welfare.” However, several warmed to it after tax increase provisions were removed.