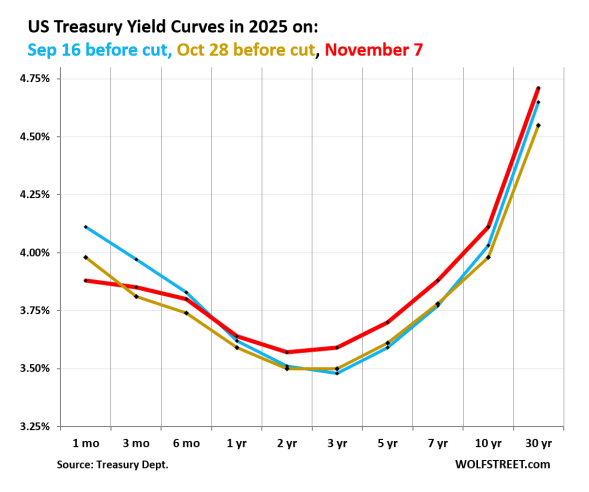

(Mike Maharrey, Money Metals News Service) Since the October interest rate cut, the entire Treasury yield curve from 3-month to 30 years has gone up.

In other words, the Federal Reserve doesn’t have nearly as much control over interest rates as it would have you believe.

And by the way, mortgage rates have gone up, too.

For example, the 10-year Treasury yield rose 12 basis points in the two weeks following the October FOMC meeting. It was up 48 basis points since the first cut in the cycle back in September 2024.

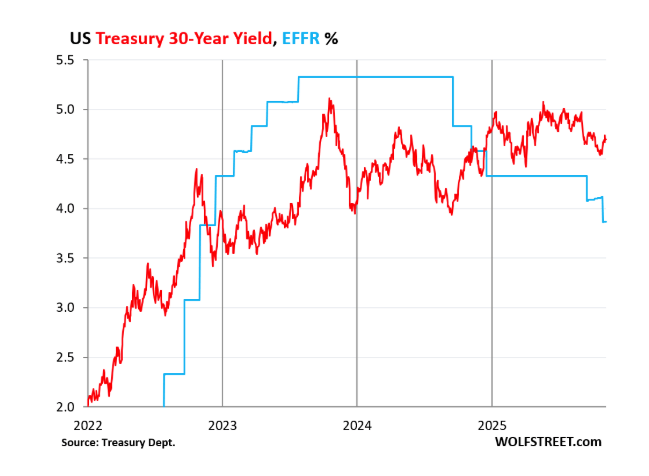

In the two weeks following the October rate cut, the 30-year Treasury yield rose from 4.55 percent to 4.70 percent. It was at 3.94 percent before the rate cut in September 2024. To put that into perspective, the Fed after 150 basis points of Fed rate cuts, the 30-year Treasury was up by 76 basis points.

Mortgage rates have also crept back up since the October Fed meeting, climbing 22 basis points in the two weeks following the rate cut.

As WolfStreet explained, long-term yields react to bond-market issues such as future inflation expectations and the supply of new bonds to be absorbed rather than the mechanizations of a central bank.

“Cutting rates as inflation accelerates is a delicate operation that the bond market is not fond of. The bond market fears a Fed that is lackadaisical in the face of inflation. And the bond market is worried about the onslaught of new supply of bonds to fund the ballooning government deficits.”

Ramifications of Rising Treasury Yields

Rising yields in the face of rate cuts tell us that demand for Treasuries is weak. This is a big problem for the Federal government as it continues to borrow and spend at a relentless pace. The federal government needs yields to fall to ease the burden of interest payments. But the world seems less and less interested in financing Uncle Sam’s debt.

WolfStreet noted, “There are rising concerns in the bond market about the ballooning U.S. debt, and about the flood of new supply of Treasury securities that the government will have to sell in order to fund the out-of-whack deficits. Treasury buyers and holders are spread far and wide, but higher yields may be necessary to reel in the mass of new buyers needed.”

Earlier this year, analyst Artis Shepherd called the situation in the Treasury market “red lights blinking.”

“The bond market is sending a message to the U.S. government that its spending is out of control and the reserve currency ‘privilege’ it has abused for the last 80 years is running out.”

Given that the Fed is struggling to control the yield curve (especially the long end), it may be forced to take more aggressive measures and restart quantitative easing to put its big fat thumb on the Treasury market.

In fact, some analysts think the Fed will relaunch QE as early as next year.

In effect, the central bank would support the government’s borrowing by creating artificial demand for Treasuries by purchasing bonds and holding them on the balance sheet. This drives prices higher and yields lower, lowering the U.S. government’s borrowing costs.

While QE would ease the government’s borrowing problem, it would increase inflation. When the Fed runs QE operations, it buys bonds with money created out of thin air and injects it into the financial system. This is, by definition, inflation.

In a nutshell, the central bank has a choice. It can fight the inflation dragon, or it can surrender to inflation and prop up the bond market. It can’t do both. History tells us the Fed will pick inflation. You should prepare accordingly.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.