(Money Metals News Service) Veteran market analyst Greg Weldon joined Money Metals’ Mike Maharrey for a sweeping conversation about the fragile state of the global financial system.

From runaway debt and stressed bond markets to gold, silver, and digital assets, Weldon delivered a no-nonsense warning: the clock is ticking.

(Interview Starts Around 5:24 Mark)

Tariff Talk and Gold’s Wild Ride

Gold’s recent surge to $3,500 was quickly followed by a sharp correction. Each tariff update or diplomatic rumor sends markets into a frenzy—rallying stocks, selling gold, or reversing course the next day. Weldon attributes this chaos to one consistent factor: uncertainty. With former President Trump’s erratic policy style still influencing market psychology, investors are desperate for any signal.

But long-term, the signal is crystal clear. Weldon says forget the noise and focus on the inevitable. The Federal Reserve will be forced to print more money. The nation is trapped in a “debt black hole,” and the only exit strategy left is inflation. What looks like chaos is actually a predictable, tragic cycle—and gold is the escape hatch.

Japan’s Trouble: A Glimpse Into the Future?

Weldon highlights Japan as a canary in the coal mine. With real interest rates sitting at -3% and a 40-year bond auction struggling, even the BOJ’s powerful tools seem to be losing their edge. Life insurers are sitting on unrealized losses. The Japanese Ministry of Finance is scrambling to rebalance its debt issuance, hoping surveys and signals can patch over structural rot.

Markets reacted as if Japan had solved the global debt crisis. Gold dropped $80 on the news. Weldon shakes his head at that reaction. For him, Japan’s debt dynamics mirror those developing in the U.S., only with a slight delay. Once the Fed steps back from the market and foreign buyers dry up, the U.S. will face the same reality.

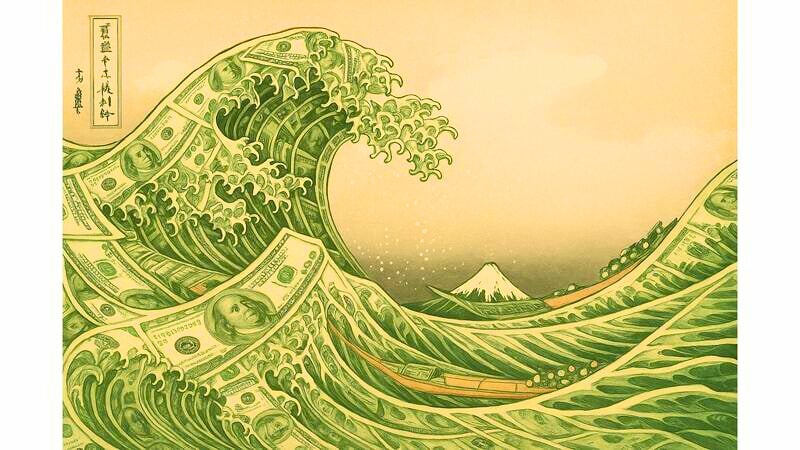

U.S. Bonds: A Tidal Wave of Trouble

In the U.S., Weldon describes an approaching “tsunami of paper.” Over $9.3 trillion in debt is maturing in the next 12 months and $1.4 trillion in new borrowing is needed in just five months. The problem? The Treasury backloaded the bulk of that issuance. Little was done in the first half of the fiscal year.

At the same time, the Fed is pulling back, shedding $50 billion per month from its balance sheet. Foreign buyers are out. That leaves the American public—already overleveraged and under-saved—to absorb the slack. Weldon argues this dynamic, where the public funds its own deficit, is absurd and unsustainable. It’s a closed loop of debt with no meaningful escape velocity.

The Fed Will Fold: QE Is Inevitable

While expectations for 2024 once included four rate cuts, we’re now looking at maybe one. But Weldon sees that as irrelevant. If the bond market cracks, the Fed will race back into the market with quantitative easing. Inflation will take a back seat to economic survival.

“They’ll be buying bonds so fast it’ll make your head spin,” he says. It’s not a question of if—it’s when. And when it happens, the dollar will weaken, gold and silver will rise, and the Fed’s credibility will shatter. The setup isn’t about market timing. It’s about macro inevitability.

Consumers Are Quietly Collapsing

While everyone’s focused on Wall Street, the consumer economy is unraveling. Credit card debt has declined four consecutive months. Revolving credit has dropped for five. The last time that happened was during the 2008 crash and the 2020 pandemic collapse. Savings fell by $35 billion in a single month.

The situation is dire. Total savings now cover just 65% of outstanding credit card debt. Delinquencies have soared—13% of balances are over 90 days late, rivaling 2010 levels. Meanwhile, consumer sentiment has collapsed to its lowest point since 1979, right before Paul Volcker’s historic rate hikes. For Weldon, this is the most overlooked crisis in the economy.

Bond Market: The 40-Year Bull Is Dead

Weldon agrees with Jim Grant that the U.S. has entered a secular bear market in bonds. The 40-year downtrend is broken. Weldon traces the shift back to 2008 when total debt surpassed GDP. Now, with total U.S. debt reaching $55 trillion—186% of GDP—it takes $1.86 of debt to produce $1 of growth. That math is unworkable.

The U.S. is burning dollars to stay afloat. Weldon describes it as propulsion in a vacuum. It doesn’t generate forward motion—it just exhausts the system. The secular trend has changed, and pretending it hasn’t is the greatest risk of all.

De-Dollarization Is Real—and Accelerating

Internationally, de-dollarization is accelerating. BRICS nations are ramping up discussions on alternatives. Asian countries are tightening trade ties. The European Union is being drawn into new alliances. And punitive U.S. sanctions are pushing countries toward non-dollar systems.

These developments are more than symbolic. They reflect a growing unwillingness to fund America’s deficits. Weldon sees this as both a political and economic turning point. Fewer buyers means higher yields. Higher yields stress the system. And gold benefits from both.

Can Gold Still Win in a High-Rate World?

Weldon challenges the idea that higher rates must hurt gold. If rates rise due to collapsing trust in U.S. bonds, gold wins. So does Bitcoin. The correlation between bond volatility and crypto prices has become striking. For many in the developing world, crypto is far more accessible than gold—and that matters.

In countries like Nigeria, Pakistan, or Turkey, digital assets are gaining traction as lifelines against collapsing fiat currencies. Weldon sees this as a powerful force that will evolve alongside physical gold demand. Both represent rebellion against paper. Both are gaining ground.

Silver: Waiting in the Shadows

Silver has frustrated many investors, but Weldon says it’s holding up surprisingly well. Despite a strong dollar, silver has stayed above $27.50, even challenging the $35 level multiple times. It hasn’t exploded yet—but its resilience is telling.

Silver’s moment will come, Weldon says, when the dollar finally breaks. And it’s close. A long-term uptrend in the dollar—stretching back to 2011—has just snapped. The setup, he says, is beautiful. Once the technical and macro stars align, silver will explode.

PGMs: The Under-the-Radar Opportunity

He’s also bullish on PGMs—platinum and palladium. Platinum in particular faces its third or fourth straight annual deficit. By year’s end, above-ground stocks could shrink to just three months of consumption. Supply is tight, demand is rising, and inventories are vanishing. That’s a powerful mix.

Weldon sees the same dynamics forming in currencies. He’s bullish on the Polish zloty, Czech koruna, Swedish krona, and Peruvian sol. Many of these currencies are closely tied to China or commodity exports. Some are breaking out technically. Others are benefiting from regional realignments and rate policy shifts.

Conclusion: Prepare, Don’t React

Ultimately, he urges investors to think bigger than headlines. The U.S. twin deficits—budget and trade—are at record levels. The dollar’s purchasing power is eroding. Central banks are buying gold. And the bond market is no longer safe. There is no soft landing. There’s just preparation or denial.

Greg Weldon recommends owning gold. Owning silver. Keeping an eye on platinum. Watching the bond market like a hawk. And, yes, owning some crypto—especially if you live in a place where trust in government money is a luxury. The monetary storm is no longer approaching. It has arrived.