(Mike Maharrey, Money Metals News Service) The budget deficit continues to balloon, with the Q1 2025 budget shortfall running 39.4 percent higher than the same period in fiscal 2024.

The Biden administration ran an $86.7 billion budget deficit in December, according to the latest Monthy Treasury Report. That pushed the first-quarter budget shortfall to $710.94 billion.

Federal tax receipts were down around 2.2 percent through the first three months of fiscal 2025. (The fiscal year begins Oct. 1.) This was primarily due to weak revenues in October. November and December receipts were higher than last year.

Overall, federal receipts have been rising over the last 18 months. The real problem is on the spending side of the ledger.

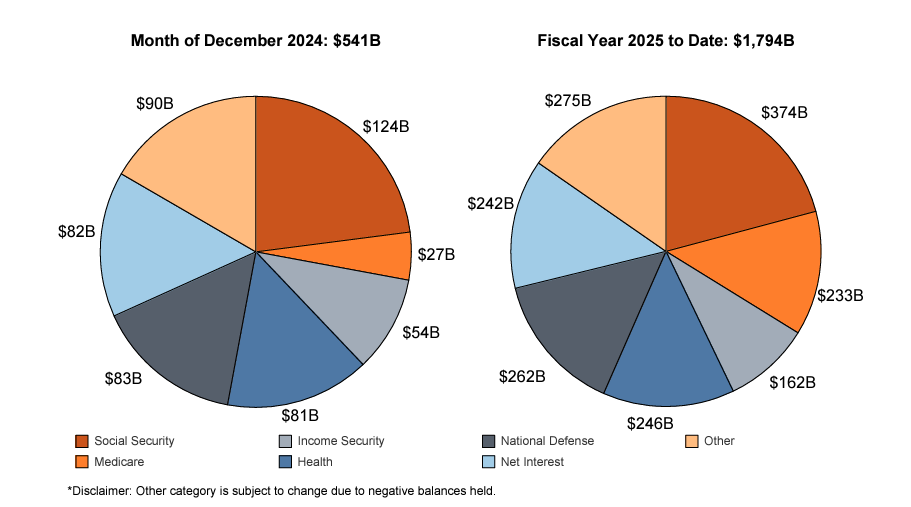

The Biden administration blew through $541.15 billion in December, pushing first-quarter spending to $1.79 trillion. Federal outlays were 10.9 percent higher in the first quarter of the fiscal year compared to the same period in 2024.

You might recall that President Biden promised that the [pretend] spending cuts would save “hundreds of billions” with the debt ceiling deal (aka the [misnamed] Fiscal Responsibility Act).

That never happened.

The federal government continues to find new reasons to spend money, whether for natural disasters at home or wars overseas. The Biden administration spent a staggering $6.75 trillion in fiscal 2024, a 10 percent increase over 2023 outlays.

The government spent $308.4 billion for interest on the national debt through the first three months of fiscal 2025, a 7 percent increase over the same period last year.

The federal government spent more on interest on the debt than it did on national defense ($262 billion) or Medicare ($233 billion) in Q1. The only higher spending category was Social Security.

Uncle Sam paid $1.13 trillion in interest expense in fiscal 2023. It was the first time interest expense has ever eclipsed $1 trillion. Projections are for interest expense to break that record in fiscal 2025.

Much of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bonds yielding much higher rates. And even with the recent Federal Reserve rate cuts, Treasury yields are pushing upward as demand for U.S. debt sags.

So What?

These big deficits pile onto a national debt that officially topped $36 trillion last month.

Some people claim borrowing, spending, and big national debts don’t matter.

They do.

According to the national debt clock, the current debt level represents 122.84 percent of GDP. Studies have shown a debt-to-GDP ratio of over 90 percent retards economic growth by about 30 percent.

And as the Bipartisan Policy Center points out, the growing national debt and the mounting fiscal irresponsibility undermine the dollar.

“Confidence in U.S. creditworthiness may be undermined by a rapidly deteriorating fiscal situation, an increasing concern with federal debt set to grow substantially in the coming years.”

This could lead to lower economic growth, higher unemployment, and less investment wealth.

Lack of confidence in the U.S. fiscal situation could also lower demand for U.S. debt. This would force interest rates on U.S. Treasuries even higher to attract investors, exacerbating the interest payment problem. As already mentioned, we’ve seen a big spike in Treasury yields despite Fed rate cuts.

Biden has run the debt higher at a dizzying pace, but to be fair, this isn’t just a Biden problem. Every president since Calvin Coolidge has left the U.S. with a bigger national debt than when he took office.

The debt will likely be one of the biggest problems facing President Trump as he takes the reins of power. With Republicans controlling both chambers of Congress and the White House, there is an opportunity to tackle the spending problem, but whether the GOP has the political will to make substantial cuts remains to be seen.

Trump has at least talked about slashing the size of government, but he’s going to need to do better than he did during his first term.

The Trump administration almost hit the $1 trillion mark in 2019 and was on pace to run a trillion-dollar deficit in fiscal 2020 before the pandemic, even as the U.S. supposedly enjoyed the “best economy” ever. The economic catastrophe caused by the government’s response to COVID-19 gave policymakers an excuse to spend with no questions asked, and we saw record deficits in fiscal 2020 and 2021.

Even if the Trump administration manages to slash discretionary spending as promised, that only accounts for 27 percent of total spending. The vast majority is for entitlements, and there is little political will to take the scissors to Social Security or Medicare.

And the sad fact is most people in positions of power are content to kick the debt can down the road. They reason, ‘Nothing has happened yet, so why worry?’ But the problem with playing kick the can down the road is you eventually run out of road.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.