(Mike Maharrey, Money Metals News Service) Declining South African mine output is contributing to the structural deficit in the platinum market, and the situation isn’t likely to improve soon.

Platinum demand outstripped supply for the third straight year in 2024.

Platinum offtake outpaced supply by 995,000 ounces last year. That was 46 percent higher than forecast. The World Platinum Investment Council projects another market deficit of around 848,000 ounces in 2025.

Above-ground stocks of platinum fell by 23 percent in 2024 and are expected to drop another 25 percent this year. This represents less than four months of demand.

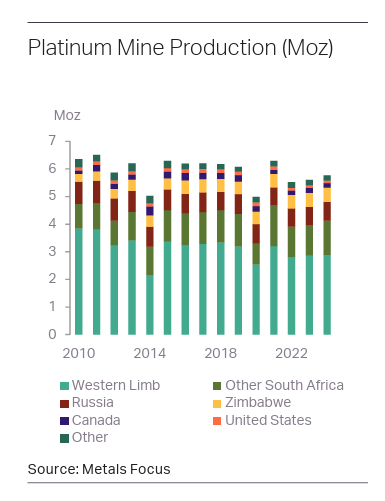

A drop in South African platinum output, particularly in the Western Limb region, is a significant factor in the declining global platinum supply.

The Western Limb accounted for 61 percent of global platinum output in 2010.

As Metals Focus put it, “Rarely in commodity markets has such a small tract of land supplied so much of the world’s demand for a single metal.”

Last year, the region’s share of platinum output fell to 50 percent, and it’s projected to drop to 47 percent in 2025.

It’s not that the area is running out of metal. Analysts estimate the Western Limb contains 454 million ounces of unmined platinum. That’s roughly 39 percent of the total known underground stock. That’s enough platinum to maintain current production for more than 100 years.

So, the problem isn’t so much that the area is running out of platinum. The issue is that the remaining metal is more difficult to mine. As Metals Focus explained, the shallow, high-grade reserves have run out, leaving deeper, more complex ore bodies that aren’t conducive to cost-saving mechanization.

As Metals Focus put it, the “dipping ore bodies” inherent in the Western Limb have proved challenging for miners.

In 2010, conventional labor-intensive mining methods dominated, producing about two-thirds of South Africa’s platinum. By 2024, that total dropped to about one-half, and it is expected to fall further.

According to Metals Focus, “Capital has migrated instead to the Eastern and Northern Limbs as well as Zimbabwe, where ore bodies are typically shallower and thicker, lending themselves more readily to mechanization and, therefore, in many producers’ view, more competitive economics.”

We saw a similar dynamic in South African gold mines. For most of the 20th century, South African miners dominated world gold production, accounting for around a quarter of all gold ever mined. However, mine output peaked in 1970. In 2024, South Africa supplied less than 3 percent of the world’s gold.

Three factors are working to the South African platinum miners’ advantage.

- Depreciation of the South African rand has kept labor costs low in dollar terms.

- An unprecedented surge in the price of rhodium between 2019 and 2022 delivered windfall cash flow and helped recapitalize some underfunded South African miners.

- Elevated chrome prices have also provided a shot in the arm for the mining industry more generally.

This has also brought some new mining interests into the region. However, the newcomers have not significantly altered the supply picture due to the timeline necessary to bring new mines to full production.

Metals Focus analysts don’t expect the overall trend to reverse. They project a continuation of the gradual decline of mine output. That means more market shortfalls in the coming years.

“With some exceptions, most incumbent producers’ mine plans indicate declining output as ageing infrastructure weighs on economics. Where new production has materialized, it has often come from restarts dependent on capital investment and infrastructure laid down in previous cycles, rather than from greenfield projects. As a result, the structural decline in platinum supply we forecast over the next five years is being driven above all by contraction in the Western Limb.”

Falling mine production and structural market deficits don’t mean we’re about to run out of platinum. But they do mean users of the metal have to tap into above-ground stocks. It generally requires higher prices to get those holding the metal to let it go.

With platinum demand increasing, the tightness on the production side is a reason to be bullish on the metal.

Platinum has been on quite a bull run this year. So far, the price is up over 48 percent. Even so, at around $1,300 per ounce, it remains far below its all-time high of $2,213 an ounce in March 2008. This was higher than the record price gold hit in 2011.

In fact, it wasn’t long ago that platinum was more expensive than gold.

It remains to be seen whether platinum will regain the price parity with gold we saw before the mid-2010s, but given the supply and demand dynamics, it is reasonable to be bullish on platinum in the near to mid-term. Given the price disparity with gold, this may signal a buying opportunity.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.