Newly released data showed the five states where Americans are most and least in debt.

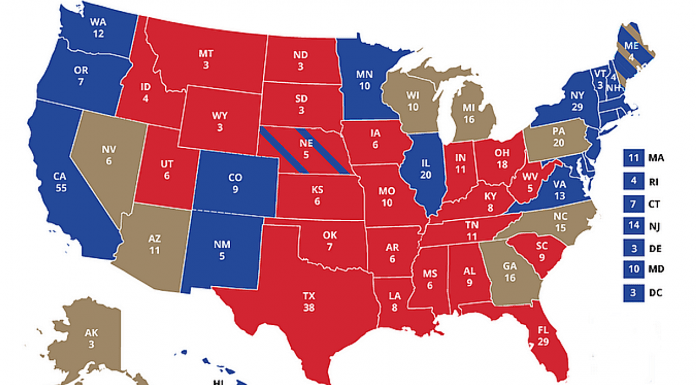

Not surprisingly, the states with the most debt burden were among the most far-left in terms of political alignment, while the majority of financially healthy states were among the reddest, or most conservative.

Forbes Advisor released the report, which found the five most indebted states by determining the per capita debt burden when considering the state government’s debt as well as state residents consumer debt, such as their credit cards and car loans.

State and consumer debts varied by state, but when taking into account population, GDP and income levels, Hawaii ranked the worst, followed by California and then Colorado. In fourth and fifth place are Oregon and then Nevada.

“Hawaii is the most indebted state, with government debt at $13,681.67 per capita,” the report said. “The total state debt balance of $19.7 billion represents 19.49% of the state’s GDP.”

Colorado, while not the worst when considering GDP, still has the highest household debt per capita, according to the report, at nearly $90,000. That figure is about the average annual earnings for residents of the state.

The next five most indebted residents by state in order are Maryland and Massachusetts with Connecticut, South Carolina and Washington tied for the next spot.

The least indebted state is Oklahoma, according to the report, followed by Iowa and a tie for third with New Hampshire and Nebraska. The fifth best state in the category is Ohio.

The next five best states, from best to worst, are Wyoming, Indiana and Wisconsin, with Vermont and South Dakota tied in their ranking.

“Idaho has the lowest per capita government debt in the nation, at $3,107.52, which accounts for 5.43% of the state’s total GDP,” the report added.

These numbers do not include the federal debt burden, which recently surpassed $100,000 per American, as the Center Square previously reported.