(Mike Maharrey, Money Metals News Service) You might want to sit down for this one.

The Bureau of Labor Statistics erased 33,000 jobs from its July and August reports with downward revisions.

Shocking, I know.

In July, the BLS reported 79,000 jobs created. In the September report (released on Nov. 20 due to the government shutdown), the agency revised the total down to 72,000.

The August report was considered abysmal when it was released, with only 22,000 new jobs created. Turns out, it was worse than abysmal. The economy shed 4,000 jobs that month, based on the revised numbers.

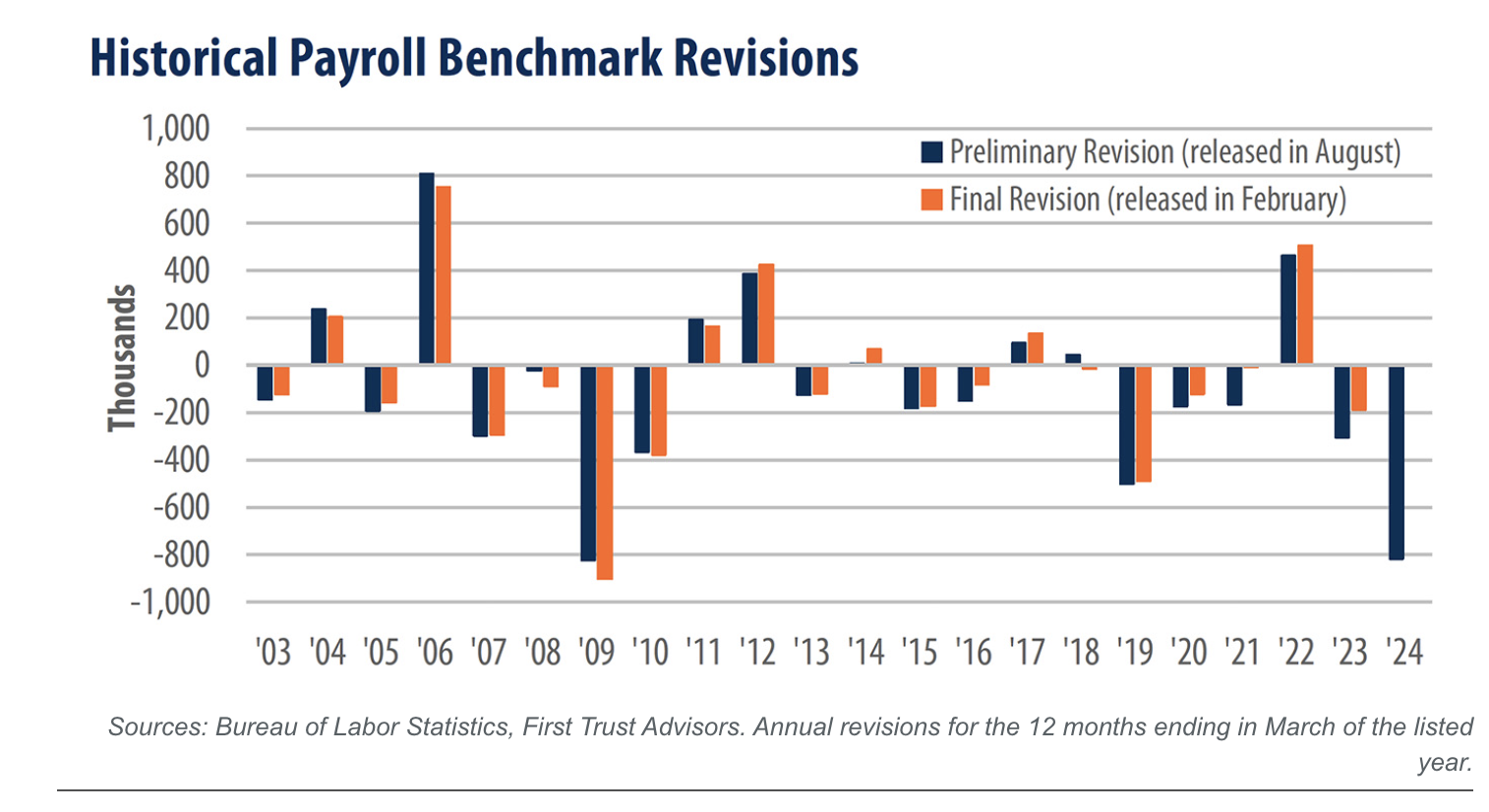

Downward revisions appear to be standard operating procedure for the BLS. The agency erased nearly 1 million (911,000) jobs that it initially claimed were created between March 2024 and June 2025.

So, what are we to make of the September report claiming the economy added a surprising 119,000 jobs? (The forecast was for just 50,000 new jobs.)

Nothing.

Because some of these jobs will almost certainly be erased next month.

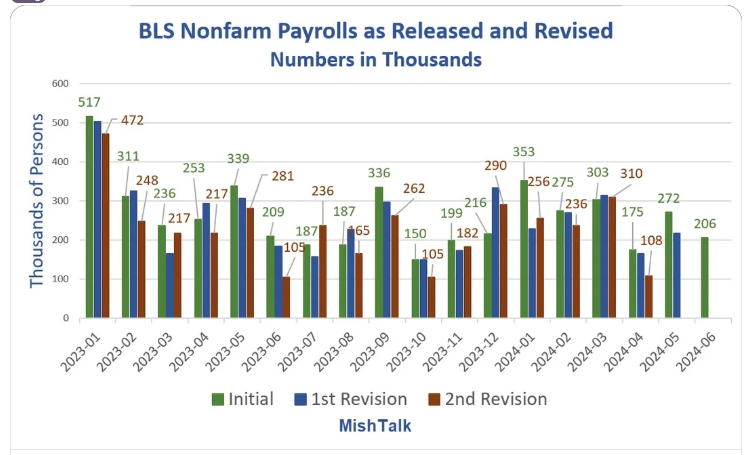

The BLS has a long history of reporting rosy job numbers only to quietly come back and revise them downward down the road. In 2023, job numbers were revised down in 10 of the 12 months.

To be fair, compiling employment data is no simple task. Revisions should be expected. But why do the updates almost always remove jobs from the economy? One would think you’d see upward revisions nearly as often as downward, right?

Nope.

Since 2003, the final annual BLS numbers were lower than the initial report 14 times compared to seven upward revisions.

It’s almost as if the agency is trying to make the government look good.

If that’s the strategy – it works.

By the way, the job numbers aren’t only sketchy data pumped out of government agencies. I’ve argued for years that the CPI data grossly understates price inflation. And we know this is on purpose because the government literally changed to formula in the 1990s to understate the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers. So, if the BLS used the old formula, we’d be looking at CPI closer to 6 percent. And using a truly honest formula, it would probably be worse than that.

It’s notable that markets only react to the initial numbers. You never see markets tank because the BLS erased a bunch of jobs from the economy with a few clicks of its calculator. The revisions happen quietly in the back alleys. Nobody pays any attention to them. That creates the illusion that the labor market is much stronger than it is.

This month, the government reports good news. Everybody celebrates. Markets move. The following month, the government quietly revises everything downward and reports that the good news was really bad news.

And nobody pays attention.

Let’s be honest; when you look at the history, one’s got to wonder why anybody takes these numbers at face value.

The lesson here is that we need to be somewhat skeptical of government data. And we need to pay attention – not just to the headline release, but the revisions as well.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.