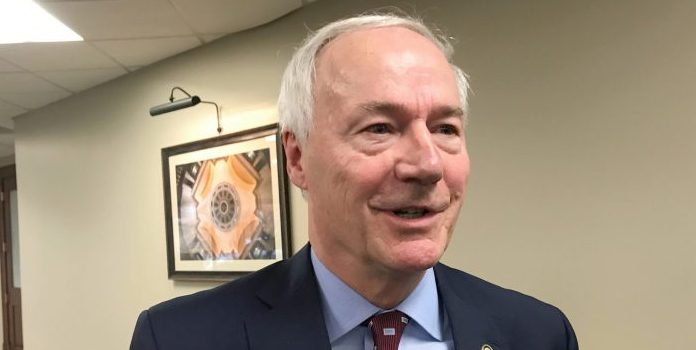

(Jp Cortez, Sound Money Defense League) By signing sound money legislation today, Arkansas Gov. Asa Hutchinson has officially ended sales taxation on gold, silver, platinum, and palladium bullion and coins– thereby setting an example for legislators in New Jersey, Maine, Ohio, and Tennessee, who are still considering similar measures in their own states this year.

Arkansas’s Senate Bill 336, originally introduced by Sen. Mark Johnson and Rep. Delia Haak, enjoyed tremendous popularity, passing through the state Senate 30-1 before passing out of the state House unanimously by a vote of 93-0.

Backed by the Sound Money Defense League, Money Metals Exchange, and grassroots activists and coin dealers in Arkansas, Senate Bill 336 will allow Arkansas investors, savers, and small businesses to acquire precious metals without being slapped with sales and use taxes.

The Arkansas sales tax exemption takes effect on July 1, 2021.

Meanwhile, similar bills are still pending in Ohio, Maine, Tennessee, and New Jersey as the national backlash against taxing constitutional money continues.

Including Arkansas, 40 U.S. states now fully or partially exempt gold and silver from sales taxes. That leaves 10 states and the District of Columbia as the primary jurisdictions that still harshly penalize citizens seeking to protect their savings against the serial devaluation of the Federal Reserve Note.

States have been removing sales taxes from monetary metals for the following reasons:

- Taxing precious metals is unfair to certain savers and investors. Gold and silver are held as forms of savings and investment. States do not tax the purchase of stocks, bonds, ETFs, currencies, and other financial instruments, so it makes no sense to tax monetary metals.

- Levying sales taxes on precious metals is illogical because gold and silver are inherently held for resale. Sales taxes are typically levied on final consumer goods. Precious metals are inherently held for resale, not “consumption,” making the application of sales taxes on precious metals illogical and especially inappropriate.

- Taxing gold and silver harms in-state businesses. It’s a competitive marketplace, so buyers in states with precious-metals sales taxes often take their business to neighboring states that have eliminated or reduced sales tax on precious metals. Investors can easily avoid paying $136.50 in sales taxes, for example, on a $1,950 purchase of a one-ounce gold bar. Therefore, levying sales tax on precious metals harms in-state businesses, who will lose business to out-of-state precious metals dealers. Coin conventions also tend to avoid the sales tax states.

- Taxing precious metals is harmful to citizens attempting to protect their assets. Purchasers of precious metals aren’t fat-cat investors. Most who buy precious metals do so in small increments as a way of saving money. Precious metals investors are purchasing precious metals as a way to preserve their wealth against the damages of inflation. Inflation harms the poorest among us—including pensioners, Arkansans on fixed incomes, wage-earners, savers, and more.

Jp Cortez, policy director for the Sound Money Defense League, explained that “the vast majority of states realize that taxing sound money harms in-state investors, in-state businesses, and even state revenues.”

Cortez continued: “by eliminating taxes on the purchase of gold and silver, Arkansas citizens can protect themselves against inflation, while citizens in the few states that still tax sound money are punished for trying to preserve their wealth.”

Having eliminated sales taxes on the monetary metals, Arkansas will rise from dead last in the Sound Money Index to 30th place among the 50 states…Original Source…

Jp Cortez is a graduate of Auburn University and a resident of Charlotte, North Carolina. He is the Policy Director of the Sound Money Defense League, an organization working to bring back gold and silver as America’s constitutional money. Follow him on Twitter @JpCortez27