(Mike Maharrey, Money Metals News Service) The S&P 500 to gold ratio has fallen to the lowest reading since the pandemic and is at a critical support level. This could signal more upside for the yellow metal.

Stocks and gold have risen in tandem in 2025. The S&P 500 is up nearly 16 percent on the year, and it has increased by 38 percent since the April selloff sparked by tariff worries.

Gold has done even better. It is up nearly 60 percent so far this year.

According to DataTrek Research, gold is beating stocks by about 1.5 standard deviations above the long-term average.

This is an extremely unusual situation. We typically see gold outperforming equities to this extent during a crisis, such as the 2008 Financial Crisis and the pandemic. It’s particularly strange to see this when stocks are going up.

As DataTek co-founders Nicholas Colas and Jessica Rabe put it, “Not only is gold’s recent performance versus the S&P unusual in terms of magnitude, but it is also coming at the ‘wrong’ time in an investment cycle.”

“There is no analog to this price action over the last two decades.”

This indicates that the same factor is driving both equities and gold higher.

What could that be?

Inflation.

Most people think inflation is just rising consumer prices. However, properly defined, inflation is the increase in the supply of money and credit. One of the symptoms of monetary inflation is consumer price inflation. However, it also manifests in assets, including stocks and real estate.

In fact, the Dow is down 36 percent in gold terms since 1939. Since gold is real, stable money, pricing the Dow in the yellow metal reveals that the appreciation of the stock market over the last century was predominantly driven by inflation.

In a nutshell, expectations that the Fed will continue to ease monetary policy are pumping more air into the stock market bubble and also driving gold higher.

What Is the S&P/Gold Ratio Telling Us?

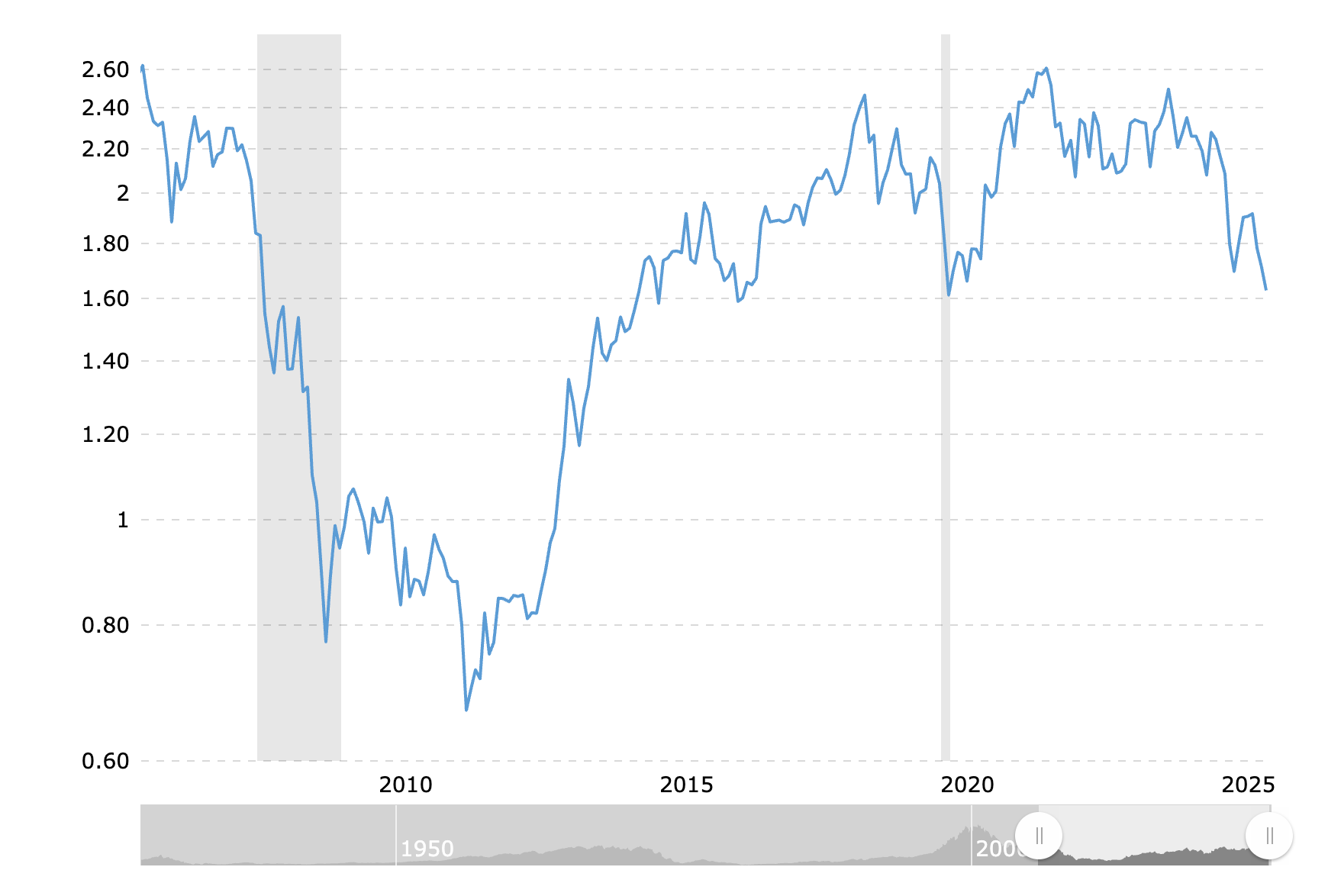

With gold rising faster than stocks, the S&P 500 to gold ratio has narrowed to around 1.66 points. That’s the lowest level since March 2020.

This indicates that the stock market is relatively cheap compared to gold. This typically happens during an economic downturn.

Bloomberg Intelligence senior market strategist Mike McGlone said, “At more than two times GDP, the U.S. stock-market wealth effect is the greatest in about a century.” Even so, he thinks the S&P 500 is on the brink of “breaching key support against gold.”

Again, we have an extremely unusual situation. Although stocks are at low levels when priced in gold, their valuation is around 2.3 times both GDP and global equities. The ratio was close to 1:1 a year ago. McGlone said a reversion to the mean, with these ratios falling in line with the S&P/Gold ratio, would be significant.

“Some reversion in SPX/GDP and SPX/MSCI toward where SPX/gold is now might look like a minor blip on the chart, but it would have severe deflationary implications.”

McGlone also said that market volatility could indicate gold will continue outperforming stocks. Current market volatility remains rather subdued based on the VIX.

“What we find concerning is that gold never rallied at such a high velocity as in 2025, with stock market volatility so low. The S&P 500 (SPX) rolling over versus gold, despite subdued stock-market volatility, might suggest greater downside risks for the SPX/gold ratio when market complacency reverses. The timing is emphasized as volatility always mean reverts; it’s a matter of time. For SPX/gold to avoid more declines, stock-market risk metrics might need to remain unusually subdued, a condition we think is increasingly unsustainable.”

The last time the S&P/Gold ratio fell below 1.7 was early in the Great Recession. It approached that level during the pandemic contraction but managed to hold support.

In a nutshell, the falling ratio could signal that the stock rally is nearing an end, with a drop in equities pushing that ratio even lower.

In other words, the stock market bubble might be about to pop as the gold rally continues.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.