(Jesse Colombo, Money Metals News Service) Morgan Stanley is predicting further euro appreciation, which should also give gold a meaningful boost, given their strong correlation.

Anyone who has followed my work over the past eight months knows I’ve been consistently bearish on the U.S. dollar — a call that has played out as the dollar has fallen about 10% against a basket of major foreign currencies this year.

I turned bearish immediately after President Trump’s inauguration, when the Dollar Index was at 108.375, and reaffirmed that stance when it dropped below 100 in the spring.

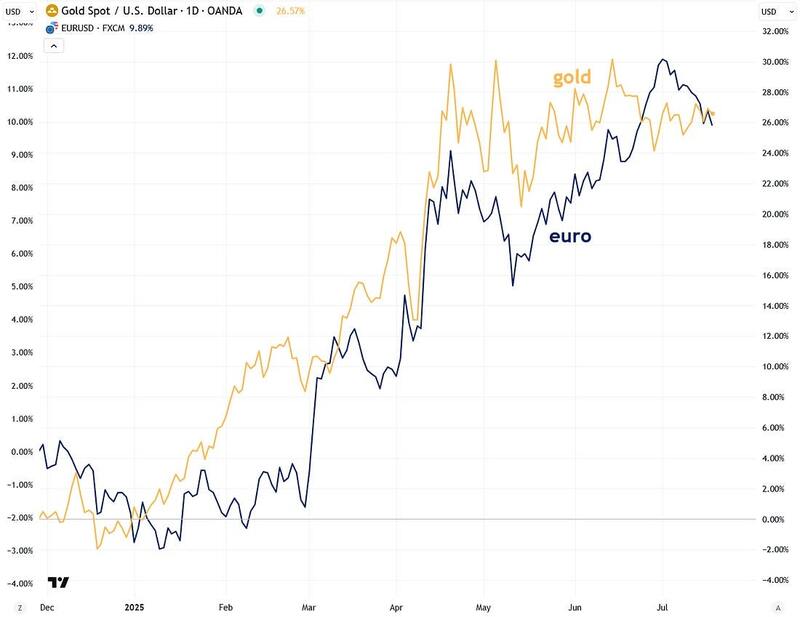

I also argued that a weaker dollar would boost the euro and commodities like gold and silver, given their inverse relationship — a view confirmed by the strong rallies in both the euro and precious metals.

Yesterday, Morgan Stanley predicted that the euro will continue climbing toward $1.30 and beyond — a roughly 12.1% rise from its current level of $1.15965.

The investment bank attributes this expected strength to European investors increasing foreign exchange hedges on their U.S. asset holdings, particularly equities, in response to ongoing dollar weakness.

According to their estimates, about $3.6 trillion — nearly half — of European-held U.S. assets remain unhedged, well below historical norms.

They added that “risks are skewed toward investors raising their hedge ratios well beyond historical averages,” which is likely to propel the euro even higher.

Morgan Stanley’s forecast aligns with my view that the euro is heading even higher — not only due to continued dollar weakness (as I’ll explain shortly), but also because of the euro’s decisive breakout in April from a long-term falling channel that had been in place since 2008, as the chart below illustrates.

Given the scale of that 15-year pattern, Morgan Stanley’s $1.30 target may ultimately prove conservative. It would be unusual for such a significant technical breakout to lose momentum so quickly.

Interestingly, the euro’s long-term falling channel since 2008 is almost perfectly mirrored by the U.S. Dollar Index’s rising channel over the same period — a reflection of their inverse relationship.

When the euro rises, the dollar falls, and vice versa. While the euro has already broken out of its channel, the Dollar Index has yet to break down from its own.

The U.S. Dollar Index recently bounced off its lower trendline, but if it breaks down from its long-standing rising channel — as it would if Morgan Stanley’s euro forecast plays out — the next key target is the 90 level. That’s a major support level marked by the index’s peaks in late 2008, early 2009, and 2010, as well as key lows in 2018 and 2021.

Notably, a drop to 90 in the Dollar Index roughly corresponds to a $1.30 euro, which reinforces the case technically.

Turning to the short-term chart of the U.S. Dollar Index, it recently broke decisively below the key 100 level — a major technical breakdown that tilts the bias toward further weakness as long as it stays below that threshold.

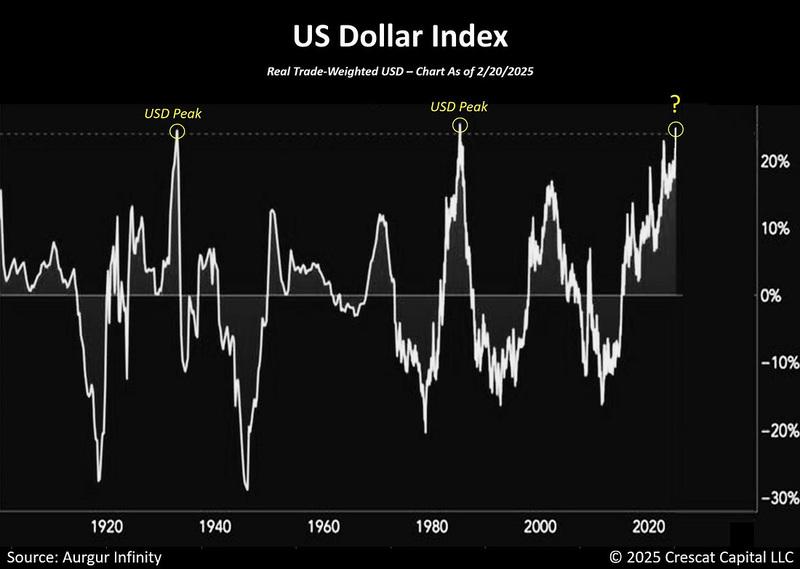

I am still quite bearish on the dollar because of its extreme overvaluation relative to other currencies, a phenomenon unseen in over 120 years of data except in 1933 and 1985—both periods followed by significant dollar declines. The dollar’s unusual strength in recent years has been a major factor keeping commodity prices much lower than they would ordinarily be.

However, further correction in the dollar’s value should continue to boost the commodities sector, including assets like copper, gold, silver, and mining stocks.

As I’ve emphasized throughout this report, Morgan Stanley’s bullish euro outlook has bullish implications for gold as well — even though the firm didn’t mention gold specifically. The two are closely correlated, trading in near lockstep since the start of the year:

Gold has been treading water in recent months, consolidating in a range between $3,200 and $3,500 — a typical summer pattern as news flow and trading volume slow with traders on vacation.

However, further euro strength, as Morgan Stanley expects, could be a key catalyst that propels gold out of this range and toward $4,000 — a target shared by both Goldman Sachs and JPMorgan.

To summarize, I firmly believe precious metals investors should closely monitor major currencies like the U.S. dollar and the euro, as their movements often offer valuable clues about the direction of metals due to long-standing correlations.

This approach, known as intermarket analysis, is a core part of my toolkit and has consistently proven valuable. I expect continued dollar weakness accompanied by strength in both the euro and precious metals, so it’s encouraging to see Morgan Stanley echoing that outlook and providing further support for why this scenario is likely to play out.

If you found this report valuable, click here to subscribe to The Bubble Bubble Report for more content like it.

Jesse Colombo is a financial analyst and investor writing on macro-economics and precious metals markets. Recognized by The Times of London, he has built a reputation for warning about economic bubbles and future financial crises. An advocate for free markets and sound money, Colombo was also named one of LinkedIn’s Top Voices in Economy & Finance. His Substack can be accessed here.