(Mike Maharrey, Money Metals News Service) What is the current inflation situation? If you just go by the CPI, things are looking pretty good.

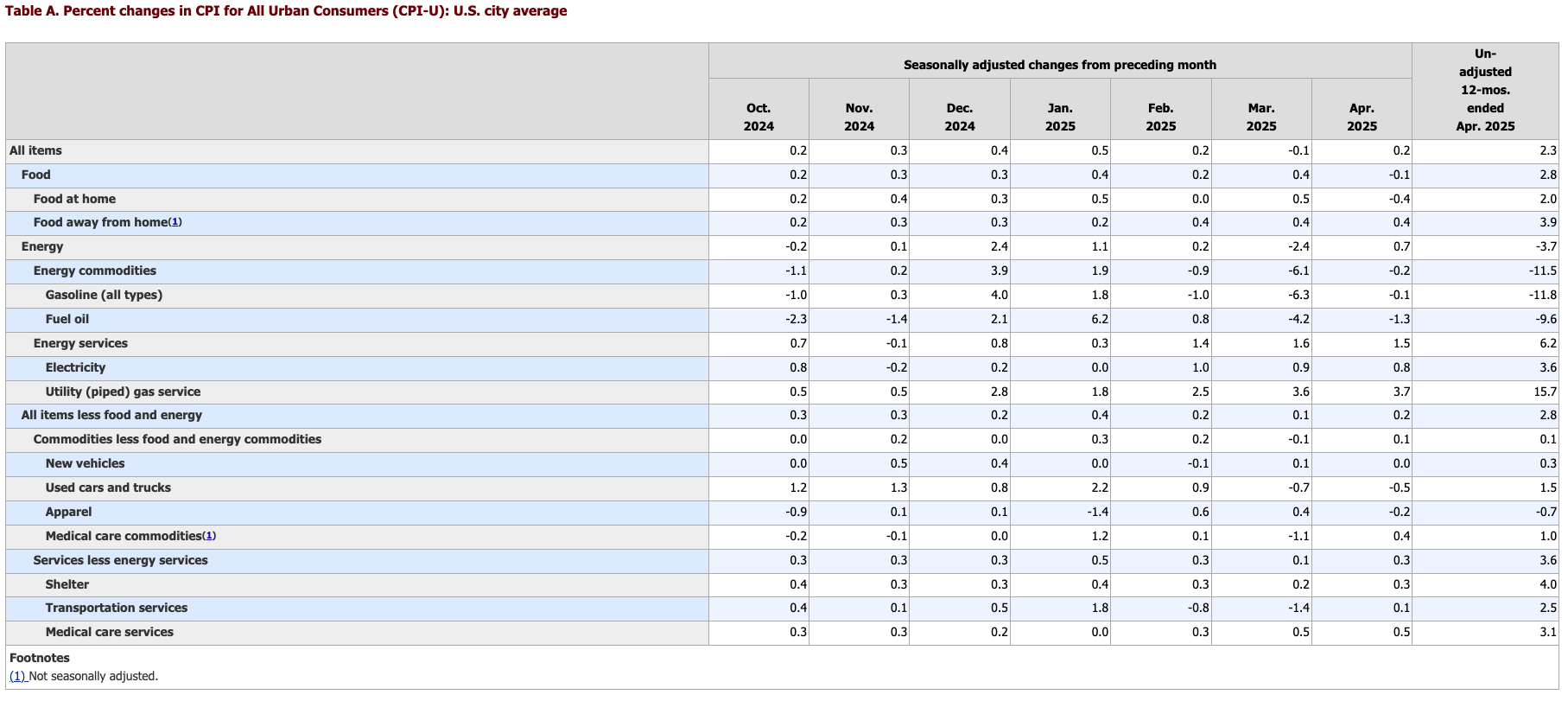

We got a better-than-expected “inflation” report for the third straight month. Prices rose 2.3 percent on an annual basis in April, the lowest rate since February 2021, according to the latest BLS data. The forecast had been for the annual CPI rate to remain at 2.4 percent.

Month on month, prices rose 0.2 percent. This was coming off a -0.1 percent contraction in prices in March but was in line with expectations.

While the CPI has dipped close to the mythical 2 percent target, core CPI remains elevated.

Stripping out more volatile food and energy prices, core CPI also rose by 0.2 percent month-on-month following a 0.1 percent rise in March. The forecast had been for a 0.3 percent increase in core prices.

Annualized, core CPI remained at 2.8 percent. Last month was the first time core CPI had dropped below 3 percent since March 2021.

As you parse the data, keep in mind that the CPI doesn’t tell the entire story of inflation. The government revised the CPI formula in the 1990s so that it understated the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers. So, if the BLS was using the old formula, we’re looking at CPI closer to 6 percent. And using an honest formula, it would probably be worse than that.

However, this is the formula the government uses, and it drives decision-making.

Falling food prices helped pull overall CPI lower. Food at home dropped -0.4 percent last month. Egg prices plunged by 12.7 percent.

Of course, egg prices aren’t indicative of “inflation.” They reflect policies enacted to combat avian flu.

Gasoline prices also dipped again in April, falling by -0.1 percent. Year on year, gasoline prices are down -11.8 percent, and overall energy prices have dropped by -3.7 percent.

Market reaction to the CPI report was muted. Analysts remain worried that tariffs will begin pushing prices higher.

A Navy Federal Credit Union economist called the CPI report “good news” with a caveat.

“And we need it given inflation shocks from tariffs are on their way. Non-tariffed goods are still in the pipeline, and perhaps some importers have absorbed their tariff costs for now.”

Of course, rising prices due to tariffs also don’t reflect “inflation” either.

They’re Defining Inflation Wrong

The problem the CPI doesn’t measure “inflation.” It measures the rise and falls of the price of a “basket of goods” picked by the Bureau of Labor Statistics. To be technical, the CPI measures “price inflation.”

But there are all kinds of factors that cause prices to go up and down. Supply and demand dynamics, supply chain issues, tariffs, and government policy can all impact prices. As already mentioned, the big dip in egg prices reflects policy changes and an easing of the bird flu outbreak.

However, there is only one thing that causes the general price level to rise – monetary inflation.

There was a time when that’s what people meant when they said inflation. They were talking about an increase in the supply of money and credit. One of the symptoms of monetary inflation is price inflation. Today, economists, commentators, and policy makers conflate price inflation and monetary inflation, calling them both “inflation.” This makes people think that there is no “inflation” if prices aren’t rapidly rising.

Inflation Is on the Upswing

Despite the chatter you hear surrounding the latest CPI report, inflation isn’t cooling. It’s heating up.

And it’s set up to heat up even more.

Even as the Fed holds interest rates steady and continues to shrink its balance sheet (albeit at a much slower pace), we’ve been seeing a rise in inflation (properly defined) for nearly a year.

The M2 money supply bottomed a little over a year ago at $20.60 trillion. Since then, it has crept upward. As of March, it was at $21.76 trillion. That eclipses the all-time high hit in April 2022.

When prices start to reflect this increase in the money supply, the powers that be will blame it on tariffs. When they do, remember the words of economist Milton Friedman.

“[Inflation] is always and everywhere a monetary phenomenon. It’s always and everywhere a result of too much money.”

In another sign that monetary policy isn’t as tight as you might think, the Chicago Fed Financial Conditions Index continues to indicate it is loose from a historical perspective. As of the week ending May 9, the NFCI stood at -0.51. A negative number reflects historically loose financial conditions.

And the markets are desperate for even looser monetary policy.

The good news from their perspective is that the CPI data greenlights further Federal Reserve rate cuts. The bad news is that means even more inflation, given that rate cuts encourage borrowing. This, in turn, boosts the money supply.

The markets aren’t wrong. This debt-riddled bubble economy runs on easy money. It can’t function in a higher interest rate environment – at least not for long.

However, there is still an inflation problem.

I’ve been talking about this conundrum facing the central bank for months, and nothing has changed.

The Federal Reserve is in a Catch-22. A few good CPI reports notwithstanding, inflation is far from dead. After all, it never did do enough to slay the inflation monster. It did just enough to paper over some of the effects of monetary inflation – and then surrendered.

On the other hand, the central bank needs to cut rates because the economy is addicted to easy money. It needs its easy money drug.

Unfortunately for Powell & Company, simultaneously raising and lowering interest rates isn’t a thing.

It’s unclear how this will all play out. One thing is clear, though – monetary inflation isn’t going anywhere, and where there is monetary inflation, price inflation will likely follow.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.