(Mike Maharrey, Money Metals News Service) In another sign that things aren’t so great on Main Street, bankruptcy inquiries hit pandemic-level highs in Q1.

More and more people are worried about a looming recession. The mainstream blames these economic worries on tariffs, but it’s pretty clear Americans started feeling the squeeze long before the trade war. Tariffs may be the pin that pops the debt-riddled bubble economy, but if not, there is another pin out there.

Most families don’t go from “everything is great” to “we need to declare bankruptcy” in a matter of days. It is typically the last resort.

In other words, this surge in bankruptcy inquiries likely reflects economic struggles that have been ongoing for months.

LegalShield’s bankruptcy index surged to 2020 levels over the last three months. The index rose to 36.4 in Q1. That was up from 33.3 in Q4 and 30.0 in Q1 2024.

This could signal a wave of bankruptcy filings later this summer.

“Bankruptcy inquiries hit the highest we’ve seen since early 2020, just before Americans’ checkbooks were boosted by COVID checks from the government. When you combine record debt, rising delinquencies, and prolonged financial stress, topped by price pressures driven by tariff uncertainty, the risk of a summer surge in bankruptcy filings becomes very real.”

Bankruptcy filings are already elevated, surging 14.2 percent year-over-year in 2024.

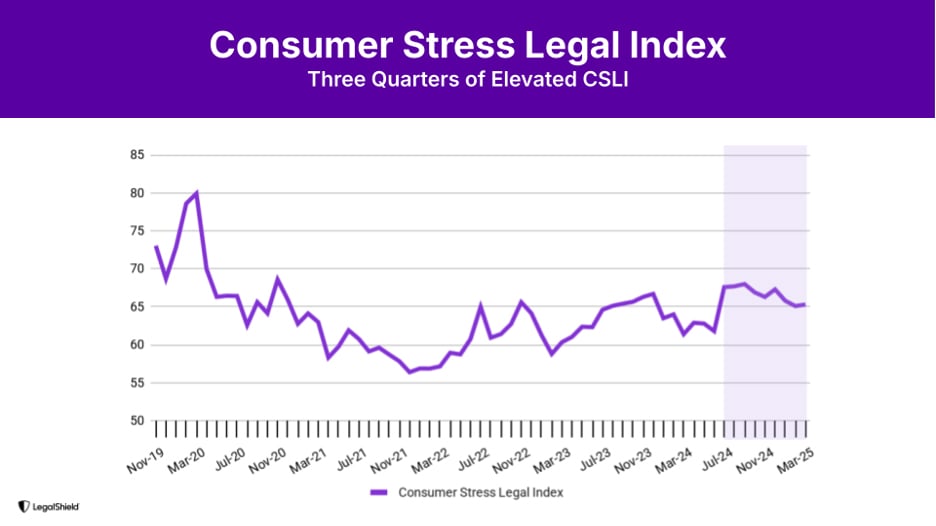

The spike in bankruptcy inquiries isn’t surprising given that LegalShield’s Consumer Stress Legal Index recorded its third straight quarter of high financial strain.

LegalShield bases its stress index on over 35 million legal service requests from its members. This “offers a unique, real-time view into American households’ financial well-being.”

The CSLI has been elevated since a spike in July 2024. It dropped modestly early this year. According to LegalShield, “The decline was driven by a significant drop in consumer finance inquiries amidst tax refund season and relatively strong employment numbers, which may be masking greater concerns as bankruptcy and foreclosure inquiries increased before tariff announcements sent the markets into turmoil.”

In an interview with Kitco News, a LegalShield spokesperson pointed out that these indices aren’t measuring sentiment or opinion.

“This is hard data that shows folks are having problems; they’re calling in today about issues they have right now. We’re not measuring how anyone feels or their emotions or their thoughts—we’re measuring the number of consumers who have a problem and are calling a lawyer because they need to solve it,”

American consumers are buried under record debt, and it’s beginning to squeeze them. The Federal Reserve Bank of New York reported that the share of households 90+ days late on credit card and loan payments rose to a 14-year high to close out 2024.

Note that this was before the tariff threat. This massive debt load was incentivized by more than a decade of artificially low interest rates courtesy of the Federal Reserve after the 2008 financial crisis.

Again — the economy is a bubble waiting for a pin.

LegalShield said the rise in the bankruptcy index could indicate the air is starting to leak out of that bubble.

“When you combine record debt, rising delinquencies, and prolonged financial stress—topped by price pressures driven by tariff uncertainty—the risk of a summer surge in bankruptcy filings becomes very real.”

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.