(Mike Maharrey, Money Metals News Service) Federal Reserve Chairman Jerome Powell doesn’t think you should be worried about a recession.

If history is any indication, you should probably be worried about a recession.

During his press conference following the March FOMC meeting, Powell called the economy “strong overall,” and he brushed aside rising concerns about a recession, saying, “We don’t make such a forecast.”

Everybody isn’t convinced.

Recession worries have swelled over the last month as the trade war kicked off in earnest. The Atlanta Fed’s GDPNow forecast plunged from a 2.3 percent growth rate in late February to -2.8 percent within a matter of weeks. It is currently at -1.8 percent.

And despite Powell’s sanguine talking points, the Fed lowered its growth forecast to a 1.7 percent pace this year, down 0.4 percentage points from what it projected in December. Granted, that’s nowhere near recession territory, but it does indicate the central bankers aren’t quite as optimistic as Powell made it sound.

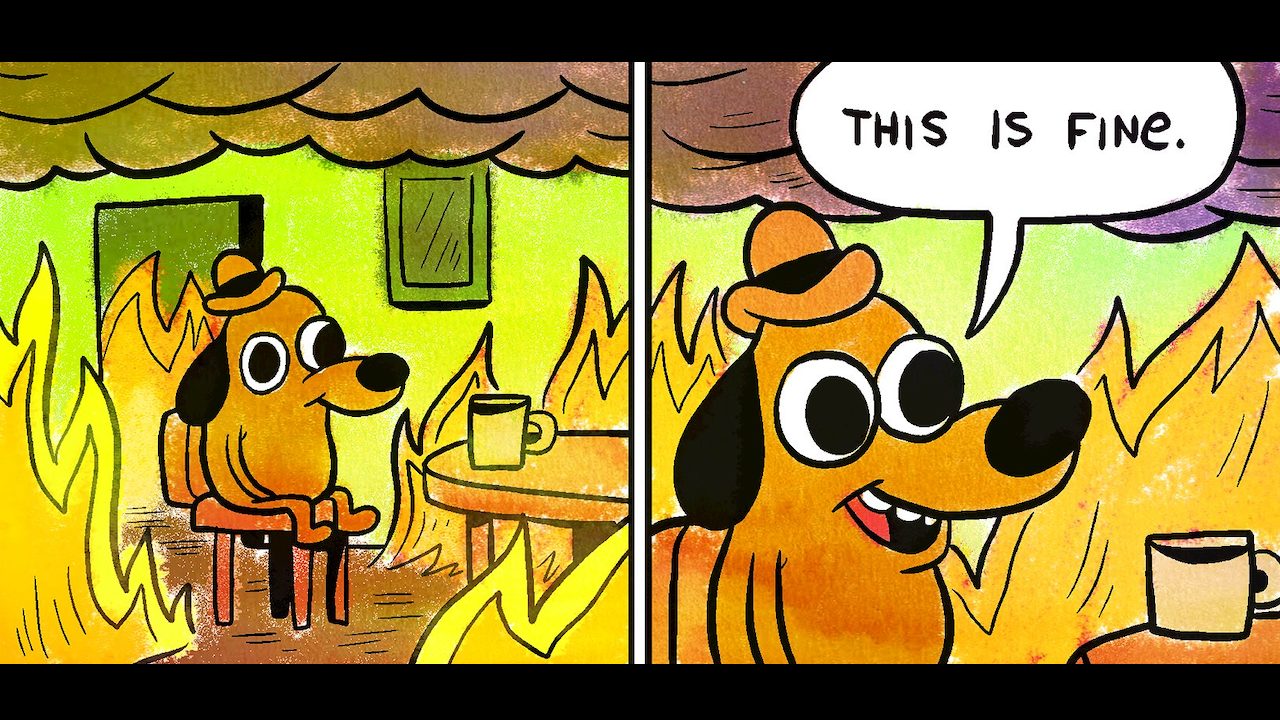

Regardless, the chairman of the Federal Reserve thinks the economy is going to be just fine. Shouldn’t that ease our worries?

Well, maybe not.

A Trip Back In Time

Let me take you back to early 2007. It was becoming hard to ignore the cracks forming in the subprime mortgage market. Some analysts were starting to warn that there could be bigger problems on the horizon.

At the time, the U.S. economy was still enjoying the boom created by the artificially low interest rates imposed by the Fed after the dot-com bubble burst. The central bank drove interest rates down to a low of 1 percent in 2002 (the lowest on record). Credit was easy, and money was flowing – especially into residential real estate.

In late 2005 and into 2006, the Fed started “normalizing” monetary policy to keep price inflation at bay. By June 2006, rates were at 5.25 percent, and they would stay at that level until the first cut in September 2007. By April 2008, rates were down to 2 percent.

And then in October 2008, Lehman Brothers failed.

The financial crisis was on.

If we overlay the interest rate history leading up to the Great Recession with the recent trajectory of rate policy, we’re currently somewhere in late 2007 or early 2008.

At that time, a few people were warning about the looming subprime crisis and the possibility of a recession, but by and large, the mainstream insisted everything was fine.

So, what was the Federal Reserve Chairman saying at the time?

Ben Bernanke said there was nothing to be concerned about. Everything was fine!

A New York Times report on Bernanke’s testimony before a congressional committee in February 2007 was headlined “Fed chairman projects ‘soft landing for U.S. economy.”

Soft landing. Where have we heard that term?

During that testimony, Bernanke said unemployment was likely to remain low over the next two years even as inflation declined slightly.

The NYT reported that his comments suggested that he was “comfortable with interest rates at current levels.” (Just like Jerome Powell is comfortable with rates at the current level today!)

As for the economy more broadly, Bernanke said it “appears to be making a transition from the rapid rate of expansion experienced over the preceding several years to a more sustainable average pace of growth.”

A month later, former Fed chair Alan Greenspan suggested the economic expansion that started in 2001 might be “running out of steam.” Bernanke thought otherwise, asserting the was no recession on the horizon.

“I would make a point, there seems to be a sense that expansions die of old age. …I don’t think the evidence supports that.”

But what about the percolating subprime crisis?

Bernanke insisted it was “contained.”

“At this juncture … the impact on the broader economy and financial markets of the problems in the subprime markets seems likely to be contained.”

He doubled down in May 2007, this time saying the subprime problem was “limited.”

“Given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited.”

Most of the mainstream media followed Bernanke’s lead. In fact, most people insisted everything was fine as late as the summer of 2008.

Of course, we all know how the story ends.

History Doesn’t Repeat…

The saying goes, “History doesn’t repeat, but it often rhymes.” Well, we can easily hear echoes of 2008 in the trajectory of today’s economy.

We had a massive injection of easy money into the economy, just like after the dot-com bubble burst. Powell had to raise rates to keep a lid on price inflation, just like Bernanke did in the early ’00s. The Fed started easing monetary policy, promising a soft landing, just like Bernanke promised in 2007.

And we have the same kinds of people telling us there’s nothing to worry about.

Maybe it’s time to worry.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.