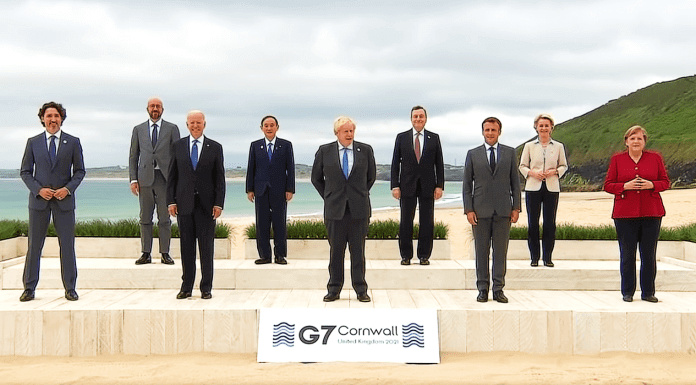

During Friday’s G7 meeting at the posh Carbis Bay Hotel in Cornwall, UK, world leaders agreed—in principle—to enact global minimum corporate taxes of 15% for member countries.

The globalist gimmick would cut down on tax competition between the developed nations, allowing big-spending liberals to maximize their public intake without suffering the adverse effects of capitalist migration.

However, critics of the proposal say that the big winners will be non-G7 members like China, which may continue to create tax incentives not available to other advanced-industrial nations.

In most cases, China has higher corporate taxes than its Westernized G7 counterparts (along with Japan, the group’s only Asian member-nation).

But for the Chinese Communist Party’s favored industries, like semiconductors, taxes are significantly smaller.

“Some of its high-tech businesses are taxed ‘well below’ 15%, and China ‘could propose carve-out measures for those sectors,’” said Wang Zecai, a researcher at the Chinese Academy of Fiscal Sciences.

The think-tank is affiliated with the CCP’s Ministry of Finance, but Wang said the comments reflected his own view rather than an official position.

“Other nations may do the same, as they may have similar domestic policies to encourage innovation,” he said.

The vote at the G7 was merely a formality as the governments agreed previously to the increase.

The top finance officials from the G7 countries came to a landmark agreement Saturday on a global minimum tax of at least 15%, a proposal pushed hard by the Biden administration as it works to ensure companies aren’t avoiding taxes by shifting profits overseas.

— Kevin Liptak (@Kevinliptakcnn) June 5, 2021

Prior to the conference, British Prime Minister Boris Johnson and US President Joe Biden released a joint statement supporting the proposal.

“We commit to reaching an equitable solution on the allocation of taxing rights, with market countries awarded taxing rights on at least 20% of profit exceeding a 10% margin for the largest and most profitable multinational enterprises,” said the statement.

Yet, back home in the US, Biden’s critics maintain that the tax agreement is all about a different kind of equity.

It’s less about fairness, and more about the radical Left’s desire for a bigger piece of the pie, said Gary Hufbauer, nonresident senior fellow at the Peterson Institute for International Economics.

“It’s part of a broader political campaign to get the tax component of the next piece of spending legislation enacted,” Hufbauer said.

With a proposed $6-trillion spending plan and little to show for it by way of projected economic growth, the Biden administration’s only option is to give American industries fewer places to flee.

The G7 proposal on taxes still needs to be approved by the separate legislatures of the G7 countries before it becomes law.

The leaders of the G7 have packaged the proposal as a sort of tax reform for the digital age, changing tax collection from where corporations are headquartered to where digital revenues are actually created—which is further expected to benefit already monopolistic Big Tech companies in the U.S.

“The removal of Digital Services Taxes, a patchwork of country-by-country taxes that specifically target the biggest American tech companies, represents a real victory for the United States,” said CNBC.